Letter 87: Is The Bull Market Over?

A look at 10 bullish and 10 bearish signals to gauge where we're at in the cycle

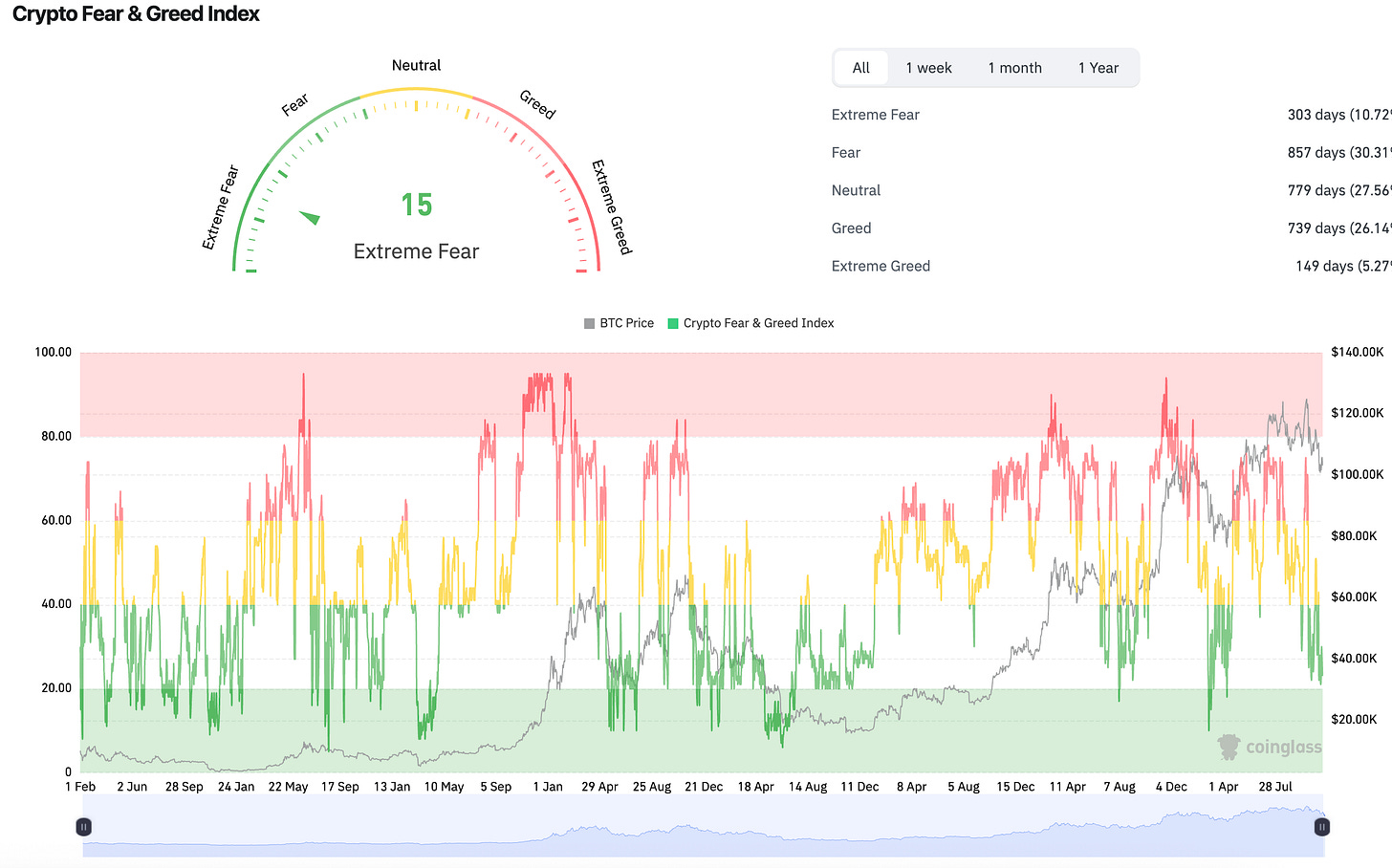

Bitcoin is at $92k, down 26% over the last six weeks. The fear and greed index is sitting in extreme fear, and many are calling this the cycle top.

Is the top in? Did the 4 year cycle really play out again? Is it time to panic and sell everything?

Back in March of this year, I wrote a similar post to this one:

Letter 56: Is The Bull Market Over?

·The question on everyone's mind lately seems to be whether the bull market is over or not. It is, quite literally, the trillion dollar question. I obviously can't tell you what's going to happen with any real certainty (and you should ignore and run from anyone who proclaims to be able to), but I can give you my best guess and, more importantly, explain how I try to think about questions like this.

In it, I spoke about the framework I use to answer questions like these and shared a list of bullish and bearish indicators that had me predict that there was a 20-25% chance the bull market was over then (therefore a 75-80% chance that the top wasn’t yet in).

I thought I would revisit that idea with an updated list, and an updated estimate of how likely I think it is that the bull is over this time around.

Reason to be Bullish

The 4 year cycle self fulfilling prophecy is causing the current dip, but it’s based on a minuscule sample size and vastly different market conditions, so this time the market will recover with strength.

Interest rates are coming down. Polymarket predicts there’s a 44% chance of another rate cut in December, a 40% chance of 2-3 cuts in 2026, and a 50% chance of 4+ cuts. Basically, interest rates are coming down. The flow-on impact of this is that money will earn less sitting in low risk assets (savings accounts, bonds, treasuries) and when that happens, money tends to flow to higher risk assets (stocks and crypto).

Privacy is becoming an increasingly important narrative and talking point in the world. As more countries crack down on physical cash and move to surveilling citizens and monitoring spending, the demand for alternate options increases. Crypto is the only solution here, and I don’t see this narrative going away any time soon.

AI continues to be the prevailing narrative in the world and crypto is also perfectly suited to pair with AI. The recent attention on the x402 protocol is a great example of this.

There are little to no blowups similar to what we saw in 2022 when everything blew up. FTX, Luna, Celsius, BlockFi, etc. The worst we’ve seen so far was the Binance-related liquidation event on 10/10, and there has yet to be significant contagion from that (in terms of big players getting blown up).

Crypto is truly becoming mainstream, and not for meme joke reasons (ala BAYC on the Tonight Show) but for legitimate apps like Polymarket, Kalshi, and Brave. Prediction markets are global and continue to grow in adoption, and well entrenched in the cultural zeitgeist. Brave is a privacy based web browser with over 100 million monthly active users. Adoption isn’t coming to crypto, it’s here.

Worldwide regulation is no longer a significant risk to harming crypto. This was one of the most significant concerns for us in the past, especially during the 2022-2023 years when the Biden administration and the SEC under Gensler were aggressively coming after crypto companies, and the rest of the world was mostly following the lead of the USA. While regulations aren’t perfect now, they’re a lot more crypto friendly, and tend to be continuing to move in a friendly direction.

Stablecoin adoption is basically at ATHs, sitting at over a $300b total market cap. The surgence of neobanks is seeing more practical use cases for stablecoins globally, not to mention novel protocols and use cases such as the aforementioned x402 designed to utilize stablecoins too.

The M2 money supply continues to skyrocket, which is historically been a great indicator of money eventually flowing to risk assets, specifically BTC. While it seems to be taking a bit longer this time, and while it’s just one data point, I don’t think it should be outright dismissed as a potentially positive indicator.

Crypto is seen as a legitimate asset class now. ETFs, regulations, retirement funds, companies, and nation states all holding the assets. It’s no longer a total cypherpunk movement, no longer edgy and niche, and no longer seen as an outright scam. So even if we crash, it’s unlikely to be like the last time. Last cycle we saw BTC suffer an 80% drawdown from 69k → 15k. I think the days of 80% drawdowns are behind us, and we might “only” see a crash of 40-50% now. Still a big deal, but given we’re down close to 30% already, I think the likelihood of a much bigger crash and bear from here to be less likely than the alternatives.

Reasons to be Bearish

Fears of a macro bubble popping that could have ripple effects throughout the entire global economy. We’ve been largely up-only since 2008, and a lot of stocks (particularly the mag 7) are at eye-watering valuations. There will eventually be a significant correction, the question is it starting now, or are there still legs in the macro cycle. Unemployment is on the rise and the cost of living crisis continues to worsen, so it feels like something is gonna come to a head soon.

Trump & Tarrifs — a wild card, nobody really knows what to expect here and it feels like the uncertainty continues to spook markets. At any given moment we could see a post from Trump talking about a new and terrible trade war with another global superpower, and it simply doesn’t instill confidence in business or in markets.

DATs are breaking down. Most Digital Asset Treasury Companies are down significantly over the last few months, with many now trading below their NAV. Many predicted that the market would be propped up by DATs for a while, but they would also result in a significant crash/correction. Again, hard to know whether this is exactly what’s happening now, but their share prices being down so much is not a good sign for things to come.

Retail never came. Everyone has been harping on about “when retail gets here…” but at this point it’s crystal clear. They are not here, and they are never coming. Not in the way we expect, and not in the way it happened previous cycles. Retail has been burned by crypto too many times now to want to come back the same way. This was the institutional cycle, with prices propped up by ETF inflows and regulatory changes inviting corporations and nations to enter the market. Kinda the antithesis of the original cypherpunk ethos actually, but it’s what made number go up.

OGs have been selling in droves. A lot of Bitcoin that hadn’t moved in 10+ years has been sold off in recent times. Whether it’s pragmatic profit taking, or a signal that OGs are losing faith in an asset that they’ve held through hell, again, we don’t know. It’s not the greatest of signs though.

While we haven’t had any blowups like we did in 2022, there have been a lot of quiet closures and companies shutting down. Projects that people have worked on for years and are now giving up on, or realizing that they’re not going to find the PMF they were hoping for.

Beyond that, the amount of Blockchains that exist now is ludicrous. Most of them are ghost chains with little user activity and little revenue, and we’re likely to see many of them shut down operations in the coming years too. A healthy cleanse imo, but will likely negatively impact markets for a bit.

There’s just a lot of exhaustion and fatigue in the market. Speaking personally, talking to friends anecdotally, and gauging timeline sentiment, people are pretty burned out and disillusioned with crypto. Fool me once, fool me 450 times, eventually, people aren’t gonna get fooled any more. Again, a healthy cleanse, and a step towards a better overall market and hopefully better overall apps and experiences for users… but likely a painful cleanse as it happens.

The 4 year cycle is absolutely playing out to a tee. I have long said I don’t believe it will play out the same way it has in the past — people have based the whole 4 year cycle largely on a sample size of 2 and things have changed drastically since last time around. But there’s a self fulfilling prophecy element that shouldn’t be dismissed, let alone the possibility that it simply does just play out the same way all over again.

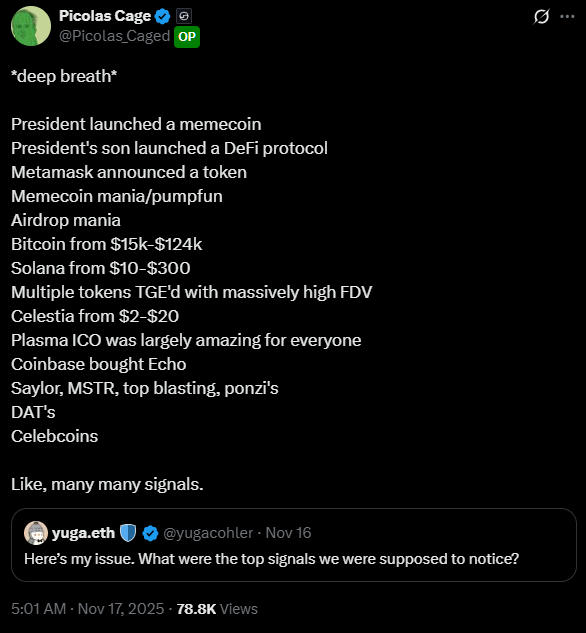

There have been.. quite a few “top signals”.

When you look at it like this, it’s been a pretty crazy cycle. I think most people don’t feel like it’s been a real bull because of how difficult it has been and how few alts have really outperformed, and especially because we never got a proper “alt szn”. But nobody said this bull had to be like previous ones, and it’s clearly been a bull market overall for a couple of years at least, with plenty of things we can look back on as top signals.

Conclusion

Putting this all together, I now put my estimates that the bull market is over at around 50%. All that for a coinflip? Well, yeah. As I wrote last time around:

If it looks like I just pulled it out of thin air and.. it’s because I kinda did.

I effectively looked at a whole bunch of reasons to be bullish or bearish and then relied on my intuition, my gut, and my experience to give me an idea of which way to lean and how strongly. Some things I weighed more heavily than others … but all of it was taken into account + more.

This is the way you have to think when trying to predict markets. You will never know anything for certain, so you must make your best guess — all we can hope is that they are educated guesses.

Back then, I estimated a 20-25% chance of the bull being over. It makes sense that the more time that goes on, the higher the chance goes, so I am making my educated guess that we’re at about the 50% mark now. Don’t take my word for it though, go through the exercise yourself and come up with your own reasons to be bullish or bearish, and then ask yourself and your gut what you feel and what percentage you put at the bull being over. If it’s 90%, you surely wanna be selling and stabling. If it’s 10%, go long baby, go long.

Just do the work yourself and come up with your own number and conviction, and then make sure you make portfolio and investment decisions based on that, and not emotion, hopium, copium, autopilot, laziness, apathy, or any of the other terrible things that we sometimes default to.

Good luck to you, good luck to us all.

May we win this coinflip and may the bull rage on at least for a little while longer.

Our new premium subscriber telegram chat

In case you missed it last week, I shared my plan on migrating away from our substack-based chat into a Telegram chat.

The intention for the chat is to be a place for premium subscribers to discuss these newsletters, to ask me any questions, and to make suggestions for future topics.

Premium subscribers can get access below:

Keep reading with a 7-day free trial

Subscribe to Letters from a Zeneca to keep reading this post and get 7 days of free access to the full post archives.