Letter 77: Let's Talk About NFTs

How I think about NFTs + Sharing how my NFT portfolio is allocated

In 2021 I traded my way to an NFT portfolio valued at over $15m starting from about $50k of initial capital. Like many people, when the bear market set in, I remained stubborn and foolish and roundtripped most of my gains. However unlike most people, I was still fortunate enough to make it through the other side of the bear with a healthy amount of profit and some still-valuable NFTs.

As you might expect, I learned a lot trading, investing, holding, and roundtripping squillions of dollars in jpegs. Today I’ll be sharing some thoughts on how I think about NFTs, how I think other people think about NFTs, my thoughts on the current state of the market, and for premium subscribers I will then share my exact portfolio and how I am thinking about it moving forward.

How I think about NFTs

Ever since I first “got” the concept of the non-fungible token, I have pretty much only ever felt extraordinarily bullish on the future of them. After the euphoria bubble popped in 2022 I would routinely get asked in interviews a question along the lines of “are you still bullish on NFTs?” — and I pretty much always responded in the same way: that I am more bullish than I have ever been.

It’s worth noting at this point that we must separate bullishness on the technology and the long term future of some collections vs bullishness on short term price action.

Despite number going down for prolonged periods, I have never doubted that NFT technology will underpin our increasingly digital future. It might take many more years from here, but the technology is simply too good, too important, and too necessary. The ability to verify provenance in a trustless and decentralized and censorship resistant manner on a public blockchain was invaluable before the internet became flooded with fake AI content.

So yeah. I am bullish on NFT technology, and many individual NFTs in existence today.

I am not bullish on the vast majority of NFTs that currently exist. Just like I don’t like most of the garbage on the internet, I don’t like most of the garbage in the NFT space.

How I think other people think about NFTs

Basically I think that most people think of NFTs as memecoins with pictures. They think of monkey jpegs, cheap art, ponzinomics, rug pulls, and all of the rest of it. They are either dismissive and don’t care to own or trade in them at all, or they are dismissive and flip them like shitcoins.

A select few can look past this and think of NFTs as a part of “projects” that are building ecosystems of value in a symbiotic relationship with their holders. I am bullish on some of these projects: Pudgy Penguins being the prime example.

Others will not care about either of the above, but instead love NFTs from the art angle. I resonate and respect this one. I think the ownership of digital art is one of the very best use cases of NFTs and always will be. It is simple, it is necessary, it works well, and it will work well forever.

Ultimately, I think the pool of people who think about NFTs the way that I do is very small. The pool of people who “get it” is very small. The pool of people who truly value NFTs from a long term perspective is very small.

But this pool has been growing slowly and steadily over time, and I don’t see that ever stopping.

This forms the basis of my thesis for holding most of what I hold: the long term accrual of value into a very select few NFT collections.

What I think about the NFT market today

The NFT market moves in a couple of different ways. It’s important to note just how small the market is. The total marketcap of ALL NFTs is just over $6 billion, and 35% of that is made up by CryptoPunks.

For reference, the memecoin SHIB has a marketcap of $7.2bn and the memecoin PEPE has a marketcap of $4bn. What about DOGE you say? Oh yeah, that silly ole memecoin has a marketcap of $32bn — even more than the memecoin Cardano which sits at $29bn!

What this mean is that it takes a relatively small amount of money to significantly move NFT markets.

We generally see this happen from a top-down approach: first Punks move, then other “blue chip” collections, and then the much lower priced items start to move / new collections start to take off. This exact flow has played out so many times now it’s almost textbook.

This is basically what happened on the fungible side of crypto for a long time too. Does this chart look familiar?

Many people swore by this for the longest time. I believe we’ve started to see this flow model fall apart as Bitcoin has been breaking away from the pack, in large part due to the absolute abundance of all other tokens. Some of the other large cap tokens have done okay, but the vast majority of “alts” have performed abysmally compared to BTC.

I think we are seeing and will continue to see the same thing happen in the NFT space. The vast majority of existing + newly released NFTs will perform abysmally compared to the established blue chips.

We’re a bit earlier in the lifecycle of the NFT market though, so I wouldn’t be surprised if there are a few more pumps and metas where hot garbage catches a bid. There’s money to be made trading em, but it’s tough to do with significant size, and the opportunity cost can be large since liquidity is often quite poor with NFTs.

All of this to say — my attitude towards NFTs basically mirrors that towards fungible tokens in that less is more and you want to hold a smaller basket of high conviction bets rather than overdiversifying down the risk curve.

There is one important distinction however: I hold some NFTs because I like them, because I love them, or because I want to support the people behind them. I have the artwork of many NFTs hanging on the walls of my home. I have an emotional connection with many NFTs. I don’t hold a single fungible token because I like the look of the code or because I love the name of the ticker, and I certainly don’t want to adorn the walls of my house with them.

NFTs can be owned to make money, or they can be owned for other reasons.

Fungible tokens are pretty much only owned to make money (stablecoins are an exception, and certain “utility” coins might be an exception, but those are extremely far and few between).

New collections vs old collections

Following on from the above, it’s pretty clear that I think the best NFTs to hold are almost always going to be from existing collections. Things that have been around for years, have accrued value, reputation, a community, culture, a cult.

This is not to say that new collections can’t do well, but we have seen very very very very few examples of new collections really taking off. They might have their moment in the sun and shine bright for a day or a week or a month, but almost all will inevitably retrace most of their gains.

This leads me to believe that NFT collections take time to grow into something valuable, and if that’s the case, why take a risk on a brand new collection when there are near infinite existing collections at extremely cheap prices to choose from?

Most of them won’t go anywhere, but most new projects won’t either. At least by sticking to older collections you can do more research and look at the history of the team and community and how they have performed (not price wise) throughout the last few years.

Or you can look at the history of the artist and their body of work and collector base and see how that has evolved over time, and try and find pieces that are undiscovered, or underappreciated.

I will occasionally take a punt on a newer collection. A recent example for me are the Bad Bunnz, an ecosystem play on the upcoming MegaETH L2, or the Anichess Ethernals, a PFP for a chess-based game that I like to nerd out on.1 And I will also occasionally buy NFTs from artists or creators or founders that I simply like, love, and/or want to support for non-financial reasons.

But if I am stepping back and purely looking at investing in NFTs from an objective perspective, I would be looking at the older stuff. Not just the “high end” older stuff too like Punks and Squiggles, but some of the PFP based projects that have stuck around and perhaps have found their way into sustainable revenue. Haven’t you heard? Revenue is cool again.

A look at my portfolio and holdings

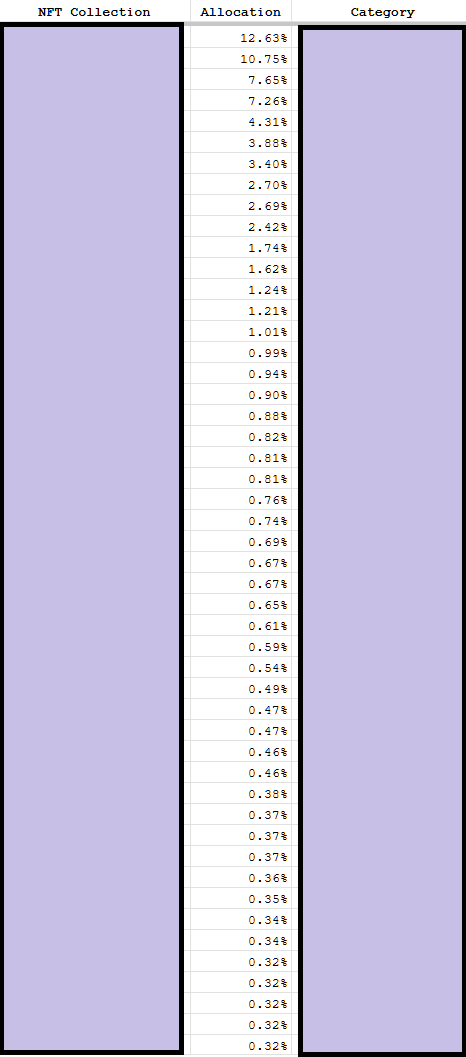

I’ve written about my portfolio review process before, and even gone through every individual token in it. But that was only for fungible tokens. Today I went through and with the help of chatGPT was able to pretty quickly create a spreadsheet of (almost) all my NFTs and their current value, which I then used to create some insightful data points.

I own NFTs that have at least a value of 0.01 ETH from a total of 259 collections (not including the many, many, many spam projects or low value holdings). There are over 1200 individual NFTs across those collections.

42% of my portfolio is in the top 5 collections

58% of my portfolio is in the top 10 collections

69% of my portfolio is in the top 20 collections

92.5% of my portfolio is in the top 100 collections

Keep reading with a 7-day free trial

Subscribe to Letters from a Zeneca to keep reading this post and get 7 days of free access to the full post archives.