Letter 91: A deeper look at Token Generation Events (TGEs)

They're always so hyped up, yet they almost never live up to the hype (pun intended)

If a project launches a token, then their TGE is one of the most important days their entire lifecycle. So why then is it a flop for most projects? Why do most users find the majority of TGEs disappointing? What can teams do to make it better for all the various stakeholders: investors, team, users? That’s what we’re going to explore in today’s post.

A Token Generation Event (TGE) is the moment a protocol’s token is minted and first becomes economically real (distributed, transferable, and tradeable). In practice, TGE day often bundles together a few distinct things:

Distribution (airdrop, launch sale, community rewards, liquidity incentives)

Initial listings (CEX/DEX liquidity and price discovery)

The start of unlock schedules (linear vesting, cliffs, emissions)

Those three forces are why TGEs produce such repeatable post launch behaviour.

What tokens tend to do after TGE

1) The median outcome is not “up only”

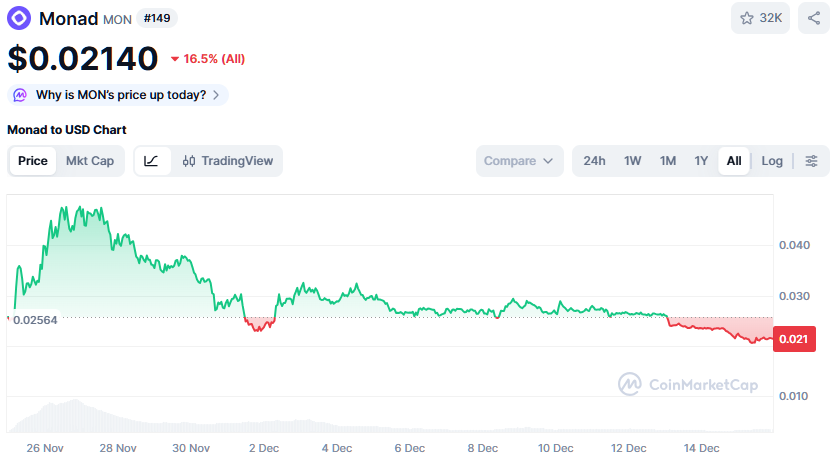

If we look across broad sets of launches, the typical token has aggressive price action at birth and struggles afterward. This creates the types of charts we’ve all become accustomed to. For example:

This is consistent with a Binance study which notes that the median FDV 14 days after launch is negative, consistent with projects being “valued at their peak upon launch.”

That matches what we all see and know in reality, and tbh probably grossly understates the situation.

There are exceptions of course, but to be honest, even they aren’t that exceptional:

2) The first days are usually the best days

There’s a structural reason many tokens rip early: low float + high attention + thin liquidity.

If you want to read more about low float + high fdv token launches, I recommend this great article by cobie.

Basically, a small amount of marginal demand sets the price to begin with, and then:

Early claimers sell to lock in profits

Perp markets open and shorting becomes possible

Liquidity deepens and price discovery gets less forgiving

Unlocks and token emissions begin, creating relentless sell pressure

This is why you’ll see the same arc for tokens over and over again:

violent launch volatility

price tops within the first few days or weeks

the long bleed or grind down begins

3) Token unlocks are real, and the market often front runs them

The last point above is worth looking at deeper, because even if the token has real product value (a huge IF, and an unfortunate rarity in our space), the emissions schedule will inform price action. This is amplified by the low float/high fdv nature of most tokens.

I found a study that looked at 16,000+ unlock events, showing that ~90% of unlocks create negative price pressure, and that impact usually begins ~30 days before the unlock.

This is entirely unsurprising news for those that follow the market or those with half a brain — of course token emissions and supply unlocks will create sell pressure and cause price to go down, it’s basic supply and demand! Remember this the next time you hear the phrase “bullish unlocks” lol.

The core point here is that the market prices dilution early, so don’t wait until the day of unlocks to take your profits, do it well in advance.

To summarize, by FAR the most common and obvious outcome of a TGE is a launch that has a token price that may or may not have an initial pump, and then inevitably goes down-only and bleeds towards zero.

So why do TGEs almost always feel disappointing?

The primary reason for a disappointing token drop comes down to expectations and how they differ among all of the different stakeholders.

VCs and investors are often looking to get some liquidity back from their investment, or at least to see the token trade at a higher valuation than what they invested at. Airdrop farmers are hoping to sell at a price that would justify however much time and capital they spent farming. The team is looking to create some liquid value for themselves to finally realize a profit on something they have usually been working on for a long time. And to top it all off, market makers and centralized exchanges wait salivating with outstretched hands, looking for their slice of the pie.

It’s practically impossible to balance all these expectations. What’s best for the investors is often not what’s best for the community. What’s best for market makers and exchanges is not best for the team. What’s best for airdrop farmers is not what’s best for VCs. And on and on.

Everyone wants their tokens asap, they want their tokens before anyone else, they want to sell at a good price. Everyone wants to make money, while also having the token price continue to go up. Kinda hard to balance that equation without insane buy pressure — and with infinite TGEs a month, there’s only so much capital to go around that can provide that buy pressure.

A few years ago it was easier for the space to rally around a few tokens, these days, it’s nigh impossible. Especially when you consider the fact that whenever there is a mega successful TGE, competitors and sharks start circling, ready to launch forks and dilute the market (see what happened and is happening with Hyperliquid vs Aster etc).

So why even launch a token?

Ah, the trillion dollar question. I honestly think well over 99.9% of tokens should not exist in crypto. So why do so many projects decide to launch them, even when they should know or expect things to go poorly? A few reasons, some more valid than others:

What they’re doing can’t exist without a token. They’re doing something fundamentally onchain and with novel mechanics that it can’t really exist without a token. This is often the best reason.

They genuinely want to decentralize the protocol and governance of it — this is probably the second best reason, but also the hardest one to actually pull off. The reality is that most people don’t care about governance, so the majority of tokens are almost always going into the hands of those who don’t actually care about the protocol and only care about making money from it.

They want to create a liquid market so that all parties can make bank. Investors, advisors, the team, and even the community. It’s hard to deliver monetary value back to everyone involved without a token.

To generate attention and mindshare, resulting in more awareness and ultimately more users of the protocol. “Come for the airdrop, stay for the product” is a mindset a lot of teams will take.

They’re feeling pressured by investors and/or community members to drop a token (hopefully I don’t need to say this, but this is by far the worst reason for launching a token).

The problem with all of this though is that whatever the intention behind a token is, not everyone will share the same perspective, because, ultimately, everyone just wants to make money. So if you’re trying to optimize for decentralizing the protocol and getting the tokens in the hands of as many people as possible, you’re going to have 100 money hungry stakeholders to every 1 genuine patron of decentralization.

So what can projects do?

What they can do and what they should do are two different things, let’s look at the former first. Often projects will try their hardest to manipulate the token’s price. This is done via the tokenomics and by keeping the circulating supply as low as possible (low float / high fdv). If there are only 5% of the tokens in circulation, it’s far easier to maintain a high price vs if 100% of the tokens are circulating.

They can also try and manipulate the price with the help of market makers —companies who specialize in providing liquidity and volume to a token upon launch to ensure a stable market as soon as the token goes live. Sometimes part of the contract is to maintain a minimum token price by providing a certain amount of buy pressure to maintain the floor.

Some reasons more respectable than others, but they all pretty much have the same goal: launch at as high a valuation as possible and have the graph go up and to the right, resulting in virtually everyone making money.

There’s also a fundamental issue that most projects that raised money have to deal with: when they’re raising funds, they generally want to raise at a high valuation so as to generate the most capital while giving up the least equity/tokens. But when it comes to TGE, the ideal scenario is to launch at a low price to allow for as much price appreciation and market goodwill as possible for the fantastic optics (there is no better marketing in crypto than a chart which goes up-only).

The best solution here is probably the raise at a lower valuation (or raise less funds). Tbh I think the vast majority of projects that raise large amounts of money do it because they can, not because they should. Once they’ve raised all that money, they have lofty expectations (self imposed and investor/market imposed), and often overcompensate in their attempt to fulfill those goals. You see this when they go on massive hiring sprees, or spend stupid money on marketing, and forget their core product and users.

So what makes for a good TGE?

Again it comes down to your perspective, but for a general list, I think these are the things that will lead people to think if a particular TGE was a success or not:

No bugs, exploits, or other technical issues with launch

Bots and snipers are minimized or straight up prevented

There’s enough liquidity for trading on decentralized exchanges

Airdrop recipients are happy, resulting in positive dialogue on social media

The token price goes up

The token price goes up

The token price goes up

At the end of the day, everything comes down to token price goes up. You can make up for bugs and bots if your token performs well. It will by default make airdrop participants happy, as well as every other stakeholder.

So, aside from the aforementioned low float and market making shenanigans, how do you make token price go up? How do you make it continue to go up long term? It starts with having a good product which people actually want to use.

Secondary to this is by having tokenomics designed in a way to make it easier for token price to go up. Control the emissions, don’t have massive unlocks overhanging, and don’t cede control to centralized exchanges and/or market makers.

In conclusion

TGE is not the finish line for a project, in many cases, it’s just the beginning. It’s basically a stress test where the protocol’s technology and the narrative surrounding it collides with supply math and market microstructure. Usually, the market wins, and inevitably humbles the project.

My two cents of advice to anyone thinking of launching a token is to ask yourself if you really need a token in the first place. Many of the most successful companies in crypto have no token (…yet): Polymarket, MetaMask, Phantom, Art Blocks, Lido. Instead, they rely on the more traditional business model of taking a small fee from each transaction. They’re all doing pretty well.

Over 99.99% of tokens fail. So if your goal is to have long term success with your token (and not just a scam exit liquidity pump), then you’re essentially betting that you’re in the 0.01%. One of the truly exceptional projects. You might be, but you probably aren’t.

There’s no shame in admitting and accepting this either because you’ll be in some damn great company if you do decide not to drop a token.

And, you can always drop a token later. You can never un-drop a token. Once it’s out there, it’s out there, and as much as you might try to market make and control the price, there really is only so much you can do. It’s out of your hands. Decentralization is a double edged sword.

And if you receive tokens at a TGE? Probably look to sell them sooner rather than lately, almost certainly within the first few days or weeks. You need to have some extreme levels of conviction for it to make sense to hold. As a project, figure out how to build those extreme levels of conviction, because we market participants are becoming increasingly jaded.

I’ll leave you with this parting thought:

Most tokens don’t underperform because the tech is bad, they underperform because they create a market where the rational trade is to sell.

Our new premium subscriber Telegram chat

In case you missed it, we have migrated away from our substack-based chat into a Telegram chat.

The intention for the chat is to be a place for premium subscribers to discuss these newsletters, to ask me any questions, and to make suggestions for future topics.

Premium subscribers can get access below:

Keep reading with a 7-day free trial

Subscribe to Letters from a Zeneca to keep reading this post and get 7 days of free access to the full post archives.