Letter 80: Managing & Spending Money (Part 1)

15 thoughts and ideas about money

Almost four years ago to the day I wrote my first Letter about money. A lot has changed for me since then and so I thought I would write another post and share a collection of thoughts and ideas I have on money these days. Making it, spending it, saving it, all of it.

Money is one of the most important things in our world and also, in my opinion, one of the most misunderstood. Most schools don’t teach kids about how money works. They don’t teach people about taxes, or investing, or budgeting, or how and what to spend your money on.

Hopefully this collection of thoughts sparks something in you that adds value to your life.

In no particular order:

Peace of mind trumps EV (expected value) every day of the week

If you can afford it, pay for quality

Being frugal is a pretty good trait, but it can definitely go too far

Think about the impact that spending money has on others

Don’t keep all your eggs in one basket, but you also don’t need a dozen baskets either

Automatic recurring investing to dollar cost average is one of the greatest ideas ever

Compound interest is a hell of a drug

One of the greatest ways to win the money game is to think longer term than others

The best tool for tracking your money is a spreadsheet you make yourself

Being on the same page as your spouse is more important than any of your other collective spending habits

Time is more valuable than money as a general rule, but enough money can make your time go further

Treat windfalls differently from earned money

Your environment sets your spending habits more than anything else

If a financial decision keeps you up at night, it was probably too big of a risk

The ultimate flex is financial independence

1. Peace of mind trumps EV (expected value) every day of the week

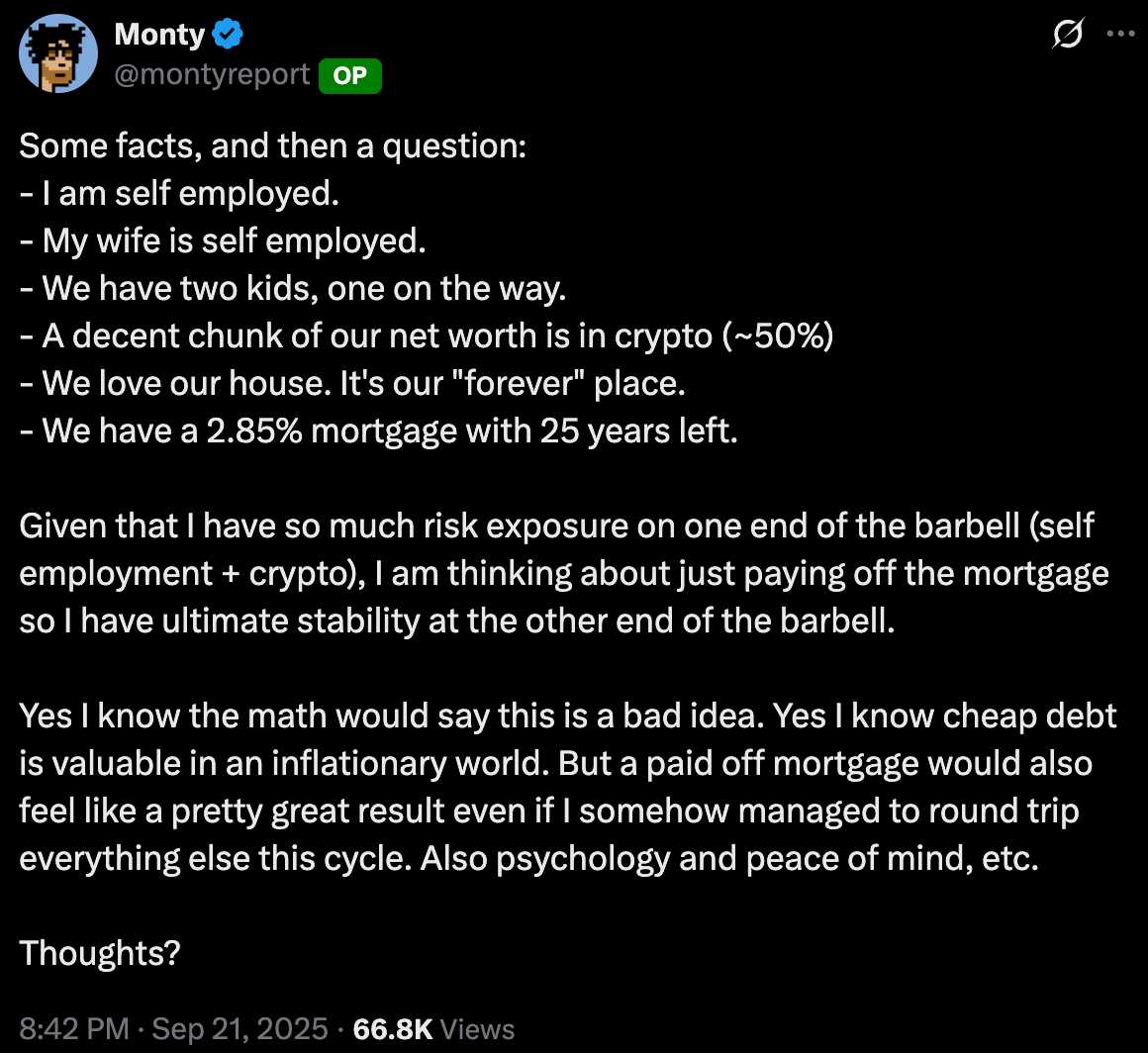

Every now and then I see a post like this pop up on the timeline:

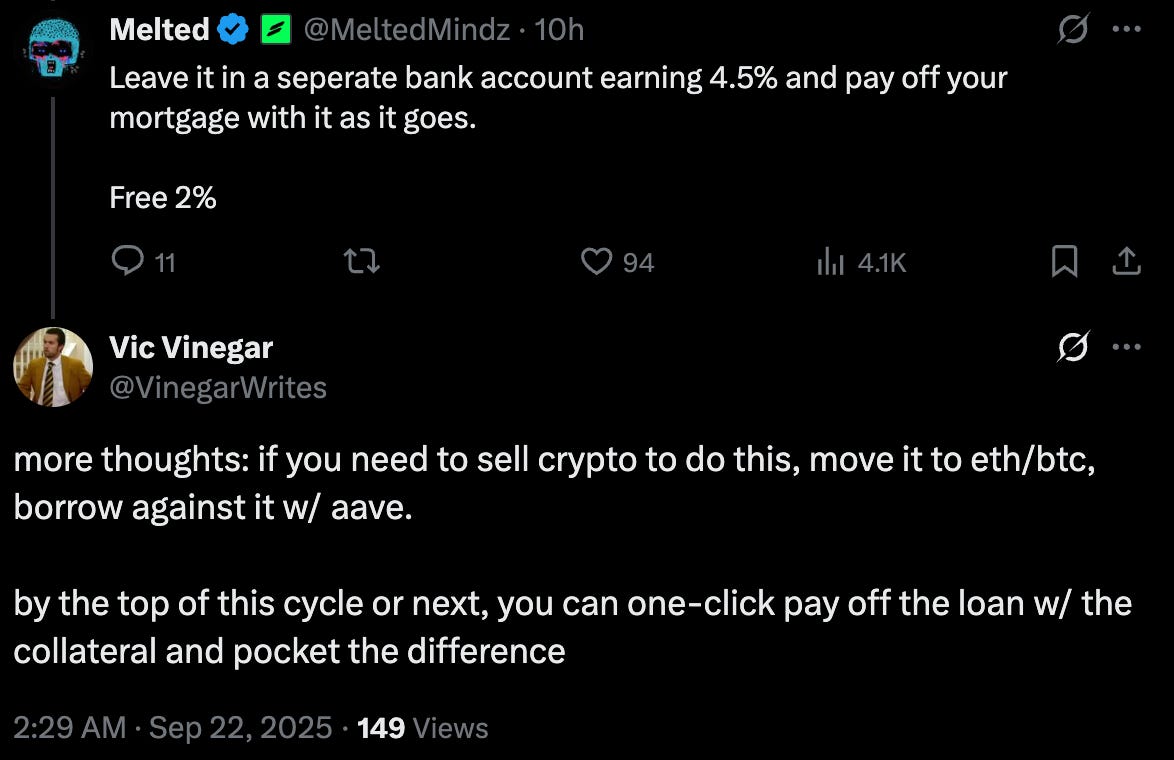

And there are always responses like these:

On the surface they make sense. It’s logical. The math maths. But it doesn’t take into account taxes, and it doesn’t take into account black swan events, and it doesn’t take into account the mental overhead of managing things, and it doesn’t take into account peace of mind and ability to sleep at night.

I’ve been in the position of having a significant mortgage, have been in the position of being a renter, and have been in the position of being able to pay off a mortgage entirely. I did the latter, and it was one of the best decisions I ever made.

Yes I sold a lot of crypto to make it happen. Yes I would have made more if I kept it all in BTC and took out a loan. Yes I would have made a little more if I had a low interest rate loan and kept the rest in treasury bonds or a high yield savings account and pocketed the difference. None of that matters.

You can’t put a price on the security of having your primary place or residence paid off and in your own hands, especially if you are otherwise working and earning in a risky industry like crypto.

I have zero regrets and I will never regret the decision to pay off our mortgage, even if it wasn’t the highest EV play in foresight or hindsight.

There’s a subset of people, in my estimation it is less than 5% of all people, who can do the logical play and still sleep just as soundly at night and paying off the mortgage isn’t the right thing for them. I just assume most people aren’t in this subset. If you can truly be like Spock, then godspeed to you.

Live long and prosper.

2. If you can afford it, pay for quality

Keep reading with a 7-day free trial

Subscribe to Letters from a Zeneca to keep reading this post and get 7 days of free access to the full post archives.