Letter 65: How To Value a Crypto Project (Part 2)

Sentiment, Tokenomics, Utility, and Risks

Last week I spoke about how valuing crypto projects was much more about art than science, and shared a few of the mindset models I thought through when trying to decide whether to buy/sell/hold something. This week I will be sharing four more things I think about, so hopefully by the end of this I’ll have shared a reasonably comprehensive overview of how I evaluate projects.

Jumping right in, here are the topics for today:

Sentiment Analaysis

Tokenomics

Utility

Risks

1. Sentiment Analysis

This is, to me, the single most important concept to understand when evaluating crypto projects. Whatever success I have had in this space, I put down to being good at this one skill: being able to identify trends early (but not too early), and basically being able to see where the wind was blowing.

The reason I think this is so important can be summed up like this:

Something is only valuable if other people think it is valuable. So the key to valuing something is in discerning what other people think, and more importantly, what they will think in the future.

So how do you figure out what other people think? Well, it ain’t easy, that’s for sure. Men and women have been trying and failing at this since Adam and Eve. If it were easy, everyone would do it, and everyone would be a genius.

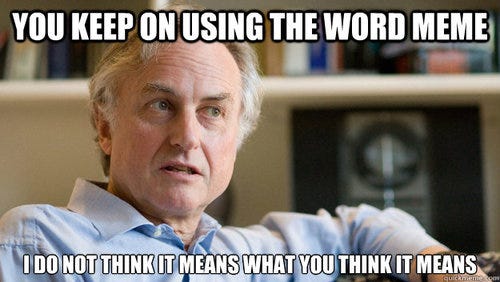

To me, it all comes down to memetics. When most people hear this word, or “meme”, their eyes tend to roll and they think we’re talking about silly cat photos or dogs wif hats.

The actual definition of a meme, as coined by Richard Dawkins, is:

an idea, behaviour, or style that spreads from person to person within a culture

Basically… anything and everything that you see on the internet, is a meme. Every comment or conversation on the internet (or not), is a meme. Every time someone lays out their thesis for a token, they are dealing in memetics. Any time someone creates an image or a graphic for a token, they are dealing in memetics. Any time someone writes a 100 page whitepaper on a token, they are dealing in memetics.

Understanding this is everything. Understanding how to distill the enormous amounts of memetic signalling out there and using it to decide whether there’s enough positive momentum (and therefore capital) behind a token to propell its price higher is everything.

How do you get good at and improve at this? Practice, practice, practice. Last month I wrote about curating your information flow, and that’s a key part of it. Try and get as much good information as you can from good and reliable sources, and practice being able to discern the good from the bad; the useful from the useless; the valuable from the valueless.

Over time, you’ll hopefully get better at seeing what works and what doesn’t. What types of information moves markets and what types are ignored by the markets. The difficult part of course is that just like genes and genetics, memes and memetics evolve. You need to be regularly questioning things and updating your worldview.

Last month I wrote all about curating your information flow, which I recommend going back and reading if you missed it since it’s directly applicable to this topic:

2. Tokenomics

The word tokenomics encompasses a lot of different things. In essence, it is anything and everything to do with the mathematics and economy behind a token. The market cap, the FDV (fully diluted valuation), the supply. The vesting schedule. The liquidity. Any staking systems or mechanisms. Any burn mechanisms. Any mechanisms which may increase supply (both circulating or god forbid total supply).

This is something that most people new to crypto (and investing in general) tend to not look too closely at. They get swept up with the narratives and the utility and the hopes and dreams and screams and memes of a token. It’s important to pay attention to these things and if there’s one thing you do pay attention to, it’s probably narrative and sentiment (see above), and sometimes that really is enough. But you’re doing yourself a massive disservice by not also looking at the tokenomics.

I’d say that the shorter term you’re looking to hold a position, the less the tokenomics matter. The longer you’re intending to hold, the more they matter. It’s largely irrelevant if there’s a massive unlock happening nine months from now if you’re planning to sell your position in 4 days, but it matters a whole heck of a lot if you’re looking at a holding time of 6 to 12 months.

There’s no one-right-answer or “best” tokenomics system or model, but here are a few of the things I look at when trying to evaluate them:

Keep reading with a 7-day free trial

Subscribe to Letters from a Zeneca to keep reading this post and get 7 days of free access to the full post archives.