Deep Dive 2: HyperLiquid & HyperEVM

The hottest thing in crypto right now — I share exactly how I am positioned for yield, airdrops, and profit

The HyperLiquid airdrop was one of the largest wealth creation events in crypto, and the performance of the HYPE token has been nothing short of remarkable. It has one of the strongest charts in crypto (as you can see below). HYPE grew by over 20x in price from the time of the airdrop to now, and it has a current market cap of ~$15bn. This puts it ahead of some longstanding giants such as LINK and AVAX, and even ahead of the hot-this-cycle SUI.

But what even is HyperLiquid? How does it work? What’s the HyperEVM? Is it worth continuing to pay attention, or has the ship already sailed? How can you get involved and get exposure to any potential future airdrop(s)?

I’ll break this all down today, and then share exactly what I am doing to get exposure to the ecosystem.

What is HyperLiquid, and what is the HyperEVM?

A surprising number of people seem to be confused about this. I’ve heard it called everything from a Layer 2, to Layer 3, to side-chain, to a simple decentralized exchange. I think a lot of the initial confusion came from the fact that in the early days, in order to get involved, you needed to bridge USDC via the Arbitrum network, which led to the L2/L3/app thoughts.

The reality is a bit more straightforward. I always find it best to go straight to the horse’s mouth, so here is how they describe HyperLiquid in their own docs:

What is Hyperliquid?

Hyperliquid is a performant blockchain built with the vision of a fully onchain open financial system. Liquidity, user applications, and trading activity synergize on a unified platform that will ultimately house all of finance.

Technical overview

Hyperliquid is a layer one blockchain (L1) written and optimized from first principles.

Hyperliquid uses a custom consensus algorithm called HyperBFT inspired by Hotstuff and its successors. Both the algorithm and networking stack are optimized from the ground up to support the unique demands of the L1.

Hyperliquid state execution is split into two broad components: HyperCore and the HyperEVM. HyperCore includes fully onchain perpetual futures and spot order books. Every order, cancel, trade, and liquidation happens transparently with one-block finality inherited from HyperBFT. HyperCore currently supports 200k orders / second, with throughput constantly improving as the node software is further optimized.

The HyperEVM brings the familiar general-purpose smart contract platform pioneered by Ethereum to the Hyperliquid blockchain. With the HyperEVM, the performant liquidity and financial primitives of HyperCore are available as permissionless building blocks for all users and builders. See the HyperEVM documentation section for more technical details.

Okay that clears it up a little but it’s still not the most straightforward and easy to understand, so here’s my take on it.

HyperLiquid is a Layer 1 Blockchain, and it has two parts:

HyperCore — this is what you interact with when you go to the main HyperLiquid app website. It’s basically a decentralized exchange where you can go to trade crypto, except it’s designed in a way that it rivals centralized exchanges (such as Binance or Coinbase) in terms of speed, being able to process 200,000 orders per second (!!). You can long or short tokens with leverage and it has many of the bells and whistles that users of CEXes are accustomed to.

HyperEVM — this is the part that looks and feels like most other Ethereum L2s, but is actually it’s own L1. It looks and feels the same because it uses the EVM (Ethereum Virtual Machine) technology stack, so that builders that are accustomed to writing and working with smart contracts on Ethereum can easily move to and from HyperLiquid. But it is not an L2 becaue it is not secured by Ethereum Mainnet. It is secured by their own custom consensus algorithm (HyperBFT).

We’re seeing all the same sorts of apps on the HyperEVM that we see on other L2s as well: launchpads, swap sites, borrowing/lending protocols, NFT marketplaces, etc.

Okay, yeah, I get why this is confusing now. Truth be told, I was still confused about parts of it until researching and writing this deep dive.

At the end of the day though, you don’t really need to know how it all works under the hood. I surely don’t; just like I also don’t know how every element of Ethereum or Solana or Bitcoin or most of the crypto tech (or non-crypto tech) that I use every day works. A high level understanding is good enough. What we really want to know is if it’s worth using, and then how to do so from a practical perspective.

So is it really still worth paying attention to?

It’s a good question. HYPE has absolutely become a consensus trade and play. It is a top 10 coin (excluding stablecoins), and has had nothing but relentless attention and mindshare (largely positive) for the better part of a year now. It’s not some hidden gem, or under-the-radar ecosystem. Everyone is aware of it.

I still think it’s worth paying attention to, and allocating a reasonable part of your portfolio to. Here’s why:

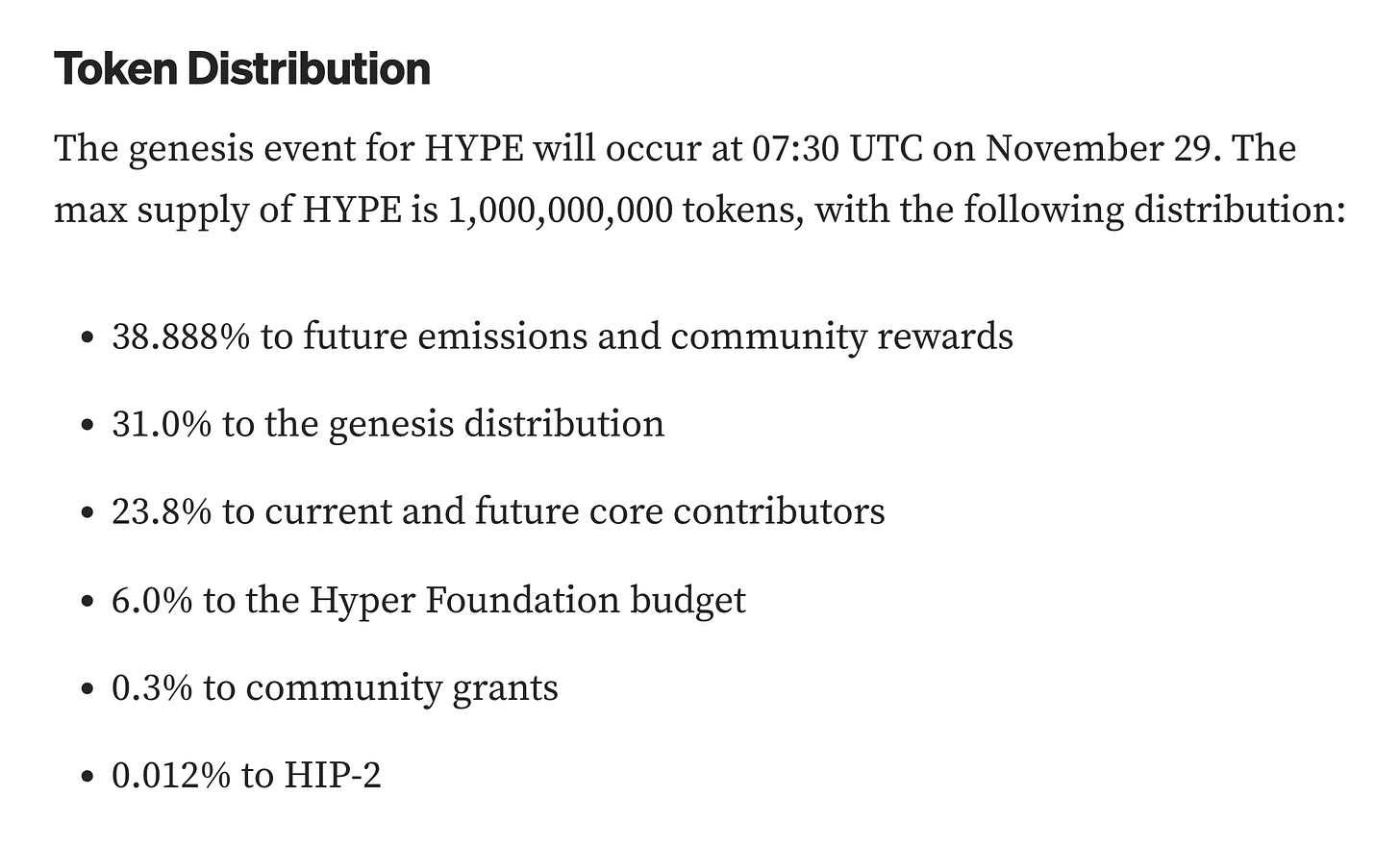

When they did their initial airdrop for HYPE, they also posted the below, effectively signalling that ~39% of the overall token supply is earmarked for future emissions and community rewards. Based on the current FDV ($45bn), that 39% represents approximately $17.55 BILLION in value to be distributed back to the community.

That’s a hell of a lot of money.

No, there’s no guarantee that there’ll be an airdrop like there was before (though there’s heavy speculation that there will be). Some % of those tokens are being distributed as staking rewards, but the community rewards element is where the airdrop speculation comes from.

Personally, I do think there will be another airdrop, and I think it will skew towards rewarding users of the HyperEVM over users of the HyperLiquid app. Why?

Well, what is the purpose of airdrops? As I wrote a couple of months ago in my Ultimate Guide to Airdrops:

to incentivize usage and adoption, to reward early users, to build goodwill, to grow a community, and/or to serve as a marketing tactic.

They’ve already rewarded early users of the main HyperLiquid app. They built a lot of goodwill, they have a killer community, and their community-led cult marketing has been second to none.

You know who they haven’t rewarded? HyperEVM users. You know what they want to icentivize usage and adoption of? Their HyperEVM product!

HyperLiquid has achieved widespread and mainstream adoption. It has whales opening billion dollar positions. Even if they do another airdrop, farming it is unlikely to yield anything significant for anyone.

If they take a similar anti-sybil and volume-weighted approach like they did with the initial airdrop, it would mean that some billionaire whales would get a couple of million worth in an airdrop (insignificant to them), and us mere mortals will twiddle our thumbs with a $600 or $60 or $6 or $0.60 airdrop, depending on size. Again, relatively insignificant to those of us trading what we consider size, and unlikely to move the needle in any direction for anyone.

If anything, it would do the opposite of what an airdrop is intended to do — it would create badwill. The HL team is too smart to do that imo.

So anyway, back to the HyperEVM. You would think that given the success of HyperLiquid, it would be absolutely flooded already. Saturated and crowded and heavily diluted, and not worth farming for that reason alone.

Bizarrely, that seems not to be the case. See this graph showing the number of daily active users — there’s only around 15-20k people poking around the ecosystem. Numbers have been growing since the early days, but not by that much (aside from that random spike). A lot of individual apps have less than 10k users.

So, it looks to me like a pretty great place to be paying attention to right now. I do think things are heating up though. We’re noticing more and more twitter threadoooors posting about it, and just more people in general talking about it (see: me). I don’t anticipate this trend slowing down any time soon. As with most crypto things, the sooner the better for getting involved.

I’d also be remiss if I didn’t address the Blast-and-other-shaped elephants in the room. A lot of what people are suggesting in terms of farming and ecosystem exposure sure looks a hell of a lot like what people (again, present company included) were suggesting back in the Blast days.

Things like: deposit here, borrow against it here, stake here, buy this NFT, get this badge, liquid re-stake some more over here, buy another NFT, add liquidity, borrow and lend and loop again, etc etc etc.

I’ve been around long enough to see history rhyme and repeat. The same threads are posted over and over and over again, for every ecosystem, all shilling threads and ref links designed by apps to farm fees and users. We saw it with Solana, with Blast, with Sui, with Avax… with just about everything.

And in most cases, it is never really worth it. The time and effort to understand the ecosystem, get your positions set up, manage them, and then look out for and manage any potential airdrops — you’d almost always have been better off doing something else.

So why do I think HyperEVM is different?

For starters: I don’t, necessarily. I think a lot of the protocols people are farming are going to end up yielding insignificant results. I think they are farming users and fees by launching points-systems. I think most of them will be worthless, and probably dead, a year or two from now.

That said… HyperLiquid has already proven itself to be a successful ecosystem, with a successful token. In all of the examples I gave, either the token had not yet launched (Blast), or there was no real hope for a native token airdrop — nobody was doing all these tasks on Solana/Sui/Avax hoping for a big airdrop of SOL/SUI/AVAX. They were doing them to farm the app airdrops alone. HL has an x-for-one situation going on, and again, with a live token that is extremely successful (not to mention resilient).

If you’re smart, you can earn a yield of anywhere from 5-40% on your funds by parking them in the right protocols (obviously with various levels of risk, but all relatively low if managed well). This is usually done by finding delta neutral strategies (aka hedging).

There is still friction involved! It isn’t always the case, but as a general rule, the more friction there is to get involved with an ecosystem, the fewer people will do it, and the greater the rewards will be for those that do. I think that’s still at play here, especially for HyperEVM.

Lastly, in case you missed it when I broke down my whole portfolio last week: HYPE is my fourth largest crypto holding (after ETH, BTC, and USDC). Actually, it’s probably third now since I bought some more today. Suffice to say, I am very bullish on HyperLiquid, HyperCore, HyperEVM, HYPE… just everything here.

That might not mean that much to you, but it is at least my explanation and one more reason as to why I personally am so happy to devote this much time, energy, and capital to the ecosystem.

So those are my reasons. I’ve been wrong before (god knows). This is a pretty consensus play at this point, and I’d be lying if this random tweet I saw didn’t trigger some PTSD and instil a tiny bit of fear in me lol:

(I still have TIA staked from late 2023 hoping for the infinity airdrops…)

But, if you wanna be active in crypto, and you wanna “do stuff”, you need to pick your battles. Lately I am taking a quality > quantity approach in just about everything — and it doesn’t get much more quality than HyperLiquid lately. That quality > quantity approach has inspired my approach to my HyperEVM activity too, which I will break down for you now.

Here’s my exact approach and breakdown of where I am allocating my time & capital on the HyperEVM

Keep reading with a 7-day free trial

Subscribe to Letters from a Zeneca to keep reading this post and get 7 days of free access to the full post archives.